Average True Range (ATR)

Video Demonstration

Description

The Average True Range (ATR) is a technical analysis indicator that measures market volatility. The ATR is typically calculated using a 14-day period, but this can be adjusted based on the trader’s preference. The ATR indicator helps traders understand the average range of price movements over a given period, indicating market volatility. High ATR values indicate high market volatility, while low ATR values suggest a period of consolidation or low market volatility.

How It Works

The Average True Range (ATR) indicator measures market volatility by considering the average range of price movements over a specified period. ATR does not indicate price direction; instead, it reflects the degree of price volatility.

Formula

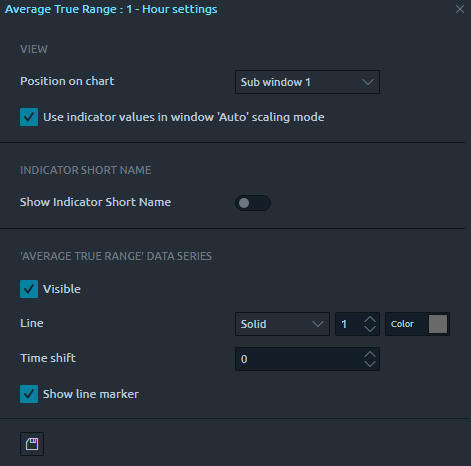

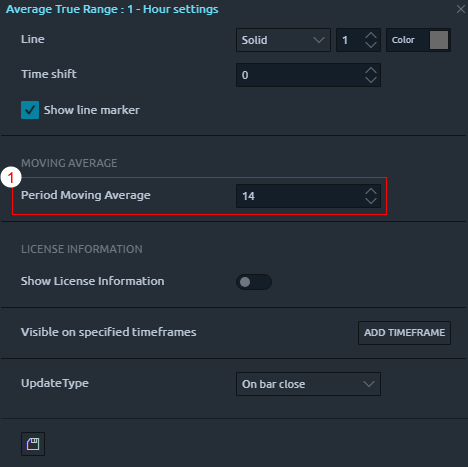

Chart Settings

* For common indicator properties please see Common Indicator Settings

"Period Moving Average"

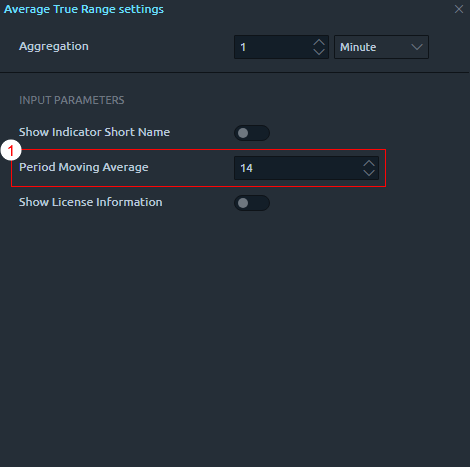

Watchlist Settings

* For common indicator properties please see Common Indicator Settings

"Period Moving Average"

Chart View