Exponential Moving Average (EMA)

Description

The Exponential Moving Average (EMA) is a weighted moving average used in trading to measure trends in financial securities. Unlike the Simple Moving Average (SMA), which assigns equal weight to all price data points, the EMA gives more weight to recent data. The EMA reacts more quickly to price changes than the SMA, making it ideal for volatile markets. It helps predict future price direction by emphasizing recent data.

How It Works

Calculate SMA for specified period. For detailed information see Simple Moving Average (SMA)

Calculate the weighting multiplier. For a 14-day EMA.

Multiply the multiplier by the current price and add it to the previous EMA value. Repeat this process for each data point.

Formula

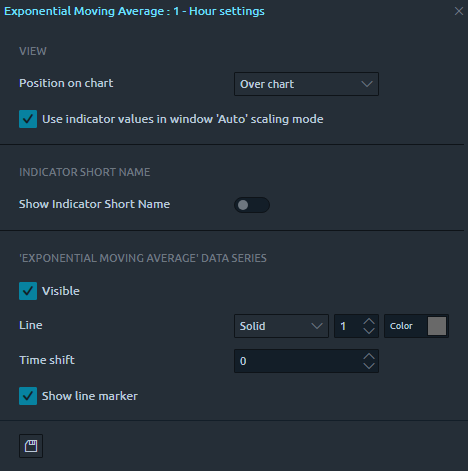

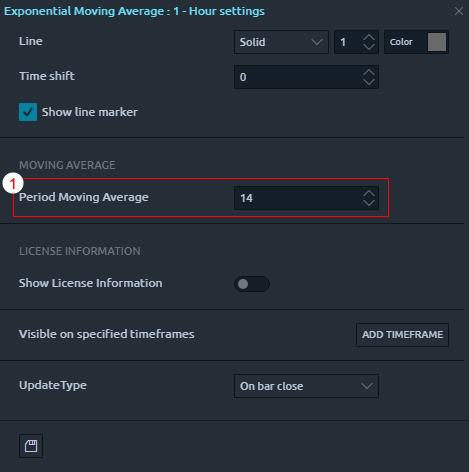

Chart Settings

* For common indicator properties please see Common Indicator Settings

"Period Moving Average"

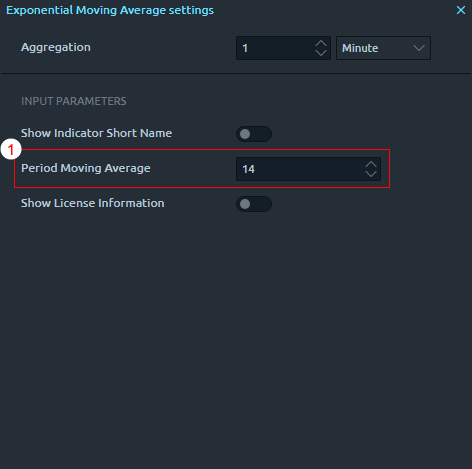

Watchlist Settings

* For common indicator properties please see Common Indicator Settings

"Period Moving Average"

Chart View